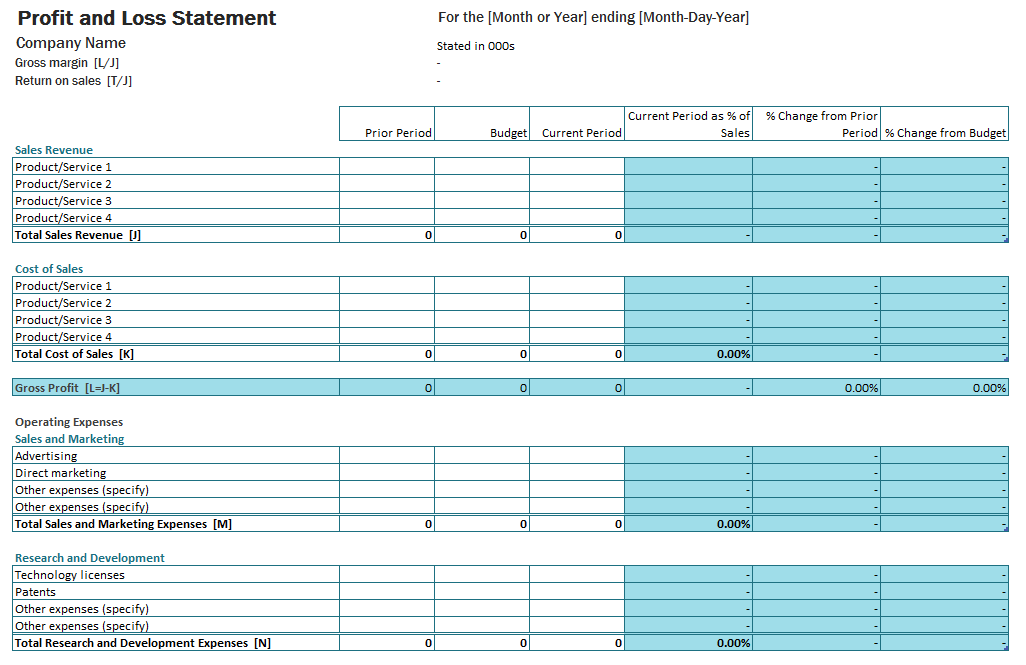

PROFIT AND LOSS ACCOUNT TEMPLATES

Create your profit and loss accounts with our samples.

Profit and Loss Account

- Microsoft Excel Profit&Loss Account Template

- File format: .xlsx

- All our profit and loss account templates are free to download

- Profit and Loss accounts help you to calculate the revenue, expenses, profit or loss your company made

- Templates are optimised for Microsoft Excel

- Create your first profit and loss account quickly and easily

DOWNLOAD YOUR PROFIT AND LOSS ACCOUNT TEMPLATE NOW

Please enter your e-mail to download the file.